We are a big fan of the Marriott brands & hotels! The company boasts some of the best hotel brands in the world! The Ritz Carlton, St Regis, The Luxury Collection & JW Marriott is just a sample of their portfolio. Their Marriott Bonvoy rewards program is free to sign up to and provides exclusive member rates & perks along with earning 10 points per USD $ on majority of their hotels. The free sign up is definitely worth it as you will be adding points with every stay which will add up in the long run! Let’s explore it more!

Should I Sign up to Marriott Bonvoy Rewards?

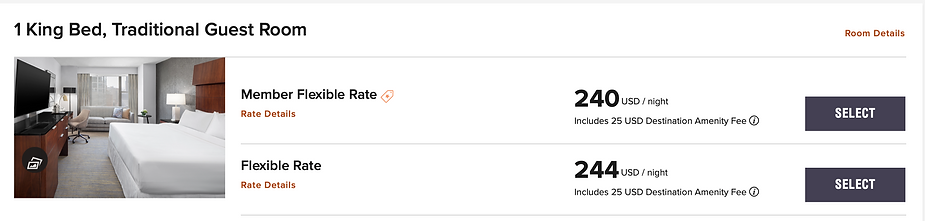

It is almost always a good idea to sign up to any hotels loyalty program! Usually it costs nothing + often there is some basic rewards for doing so! Marriott is no different! Their loyalty program is free to sign up to and you’ll get access to discounted member rates instantly & begin accumulating points with each stay. Sometimes these discounted rates can be great so it’s worth spending the 5 minutes signing up to lock in the discounts. In the example below, the member discount is not amazing but hey it’s still a discount!

Image: Example Member Discount on a Marriott Property

Should I transfer AMEX points for Marriott Bonvoy Points?

To work out if it is beneficial transferring points from AMEX to Marriott Bonvoy we need to weigh up our other options. For this example, we are weighing up the redemption value between transferring AMEX points to Singapore Airline miles VS Marriott points.

For this example we will be using 137K AMEX points to make the example easy to explain.

Redemption Values:

2x AMEX points = 1 Singapore Airlines Point (at time of writing) = 68.5K Points

3x AMEX points = 2 Marriott Points (at time of writing) = 91K Points

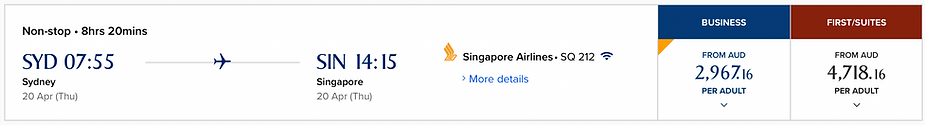

Singapore Airlines Redemption Value:

137K AMEX points = 68.5K Singapore Airlines Points

68.5K Singapore Airlines Points = Assuming you get Business Saver Rate =

1x One Way Business Class ticket Sydney to Singapore + $92 in taxes

That same flight/ticket using cash (No points) = $2967 AUD

Therefore, the value from 137K AMEX points converted into Singapore Airlines points when used on a business class saver redemption in this example equates to $2875 AUD (given it is cash cost – $92 as points redemption had $92 in taxes excluded).

How does this compare to Marriott Bonvoy transfers?

Marriott Bonvoy Redemption Value: 137K AMEX points = 91K Marriott Points

To work out what the redemption values are for Marriott Bonvoy, we need to check multiple hotels across multiple countries and then determine the average value associated with points. Let’s look at some examples below:

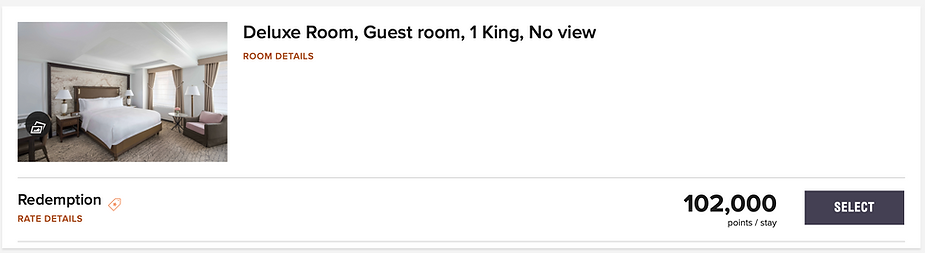

Ritz Carlton Central Park, New York, USA:

Cash Price: $1272 AUD

Points Price: 102K Points

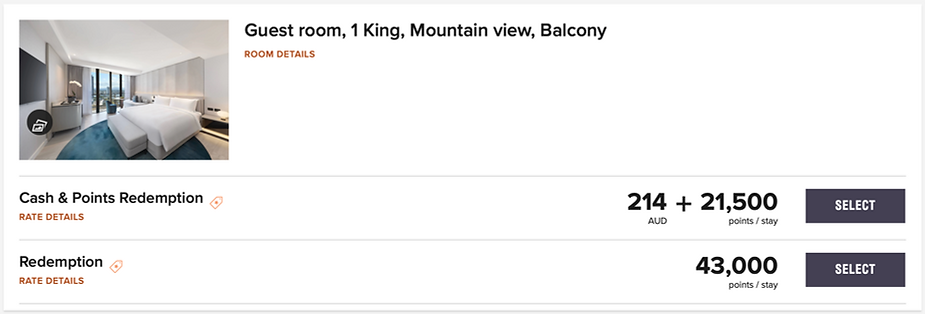

JW Marriott Gold Coast, Australia:

Cash Price: $369 AUD

Points Price: 43K Points

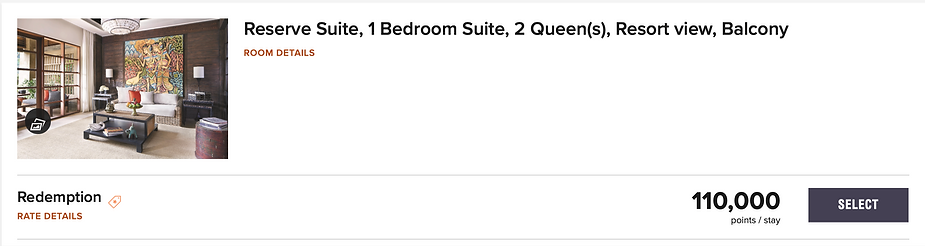

Mandapa, Bali, Indonesia:

Cash Price: $1689 AUD

Points Price: 110K Points

Marriott Value associated with Points Redemptions:

We just compared 3 different hotels in 3 different countries to try to establish how much value Marriott contributes to point redemptions. From the above examples, it results in the following values:

91K Marriott Points (conversion from AMEX points) contributes to:

- $1134 AUD worth in NYC, USA

- $780 AUD worth in Gold Coast, Australia

- $1396 AUD worth in Bali, Indonesia

On average, 91K Marriott Points = approx $1100 AUD.

AMEX points to Marriott or Singapore points?

So to conclude our findings, transferring 137K AMEX points will give you:

- 91K Marriott Points = approx $1092 AUD in value

- 68.5K Singapore Airlines Points = approx $2875 AUD in value

In dollar terms, Singapore Airlines looks like a better redemption but everyones scenario is different. If you have a redemption specific to Marriott Bonvoy points don’t let that stop you transferring!

How much do Marriott Points cost to buy?

From the official Marriott website, you can buy 100K Marriott Bonvoy points for $1250USD. This would equal approx $1816 AUD. From the data above, the true value of an average redemption only equates to approx $1200 AUD worth of value meaning during a normal period it is not worthwhile to buy points instead of paying with cash. Saying this, Marriott, sometimes have a sale a couple of times a year where you can buy the points at a heavy discount. A 50% off sale meaning 100K points would cost you approx $900 AUD would be decent value given you should be able to redeem it for more than you bought it for.

Game Plan:

- Sign up for Marriott Bonvoy Rewards Program if you are staying in any of the associated hotels in the future (it is a free program after all)

- Continue to collect points with every stay in associated hotels into the future as points will continue to add up (although must add to points balance or make a redemption ea 24 months or points expire)

- At 10 Points per USD spent, over time, your balance will add up to a significant redemption if staying in Marriott hotels every once in a while

- IF Marriott have a 50% off sale and you can buy points at a far cheaper rate than the average redemption value (as per example above), consider buying them if you have an upcoming trip planned. Do the maths prior to buying and calculate using your specific hotel given redemption values vary.

- We don’t see value in transferring AMEX points to Marriott Bonvoy points at the current redemption values as value can be redeemed to other partners for greater value (as per example above)